- info@srhworld.com

- +91 (20) 24616106 | Helpline : +91 84849 14844

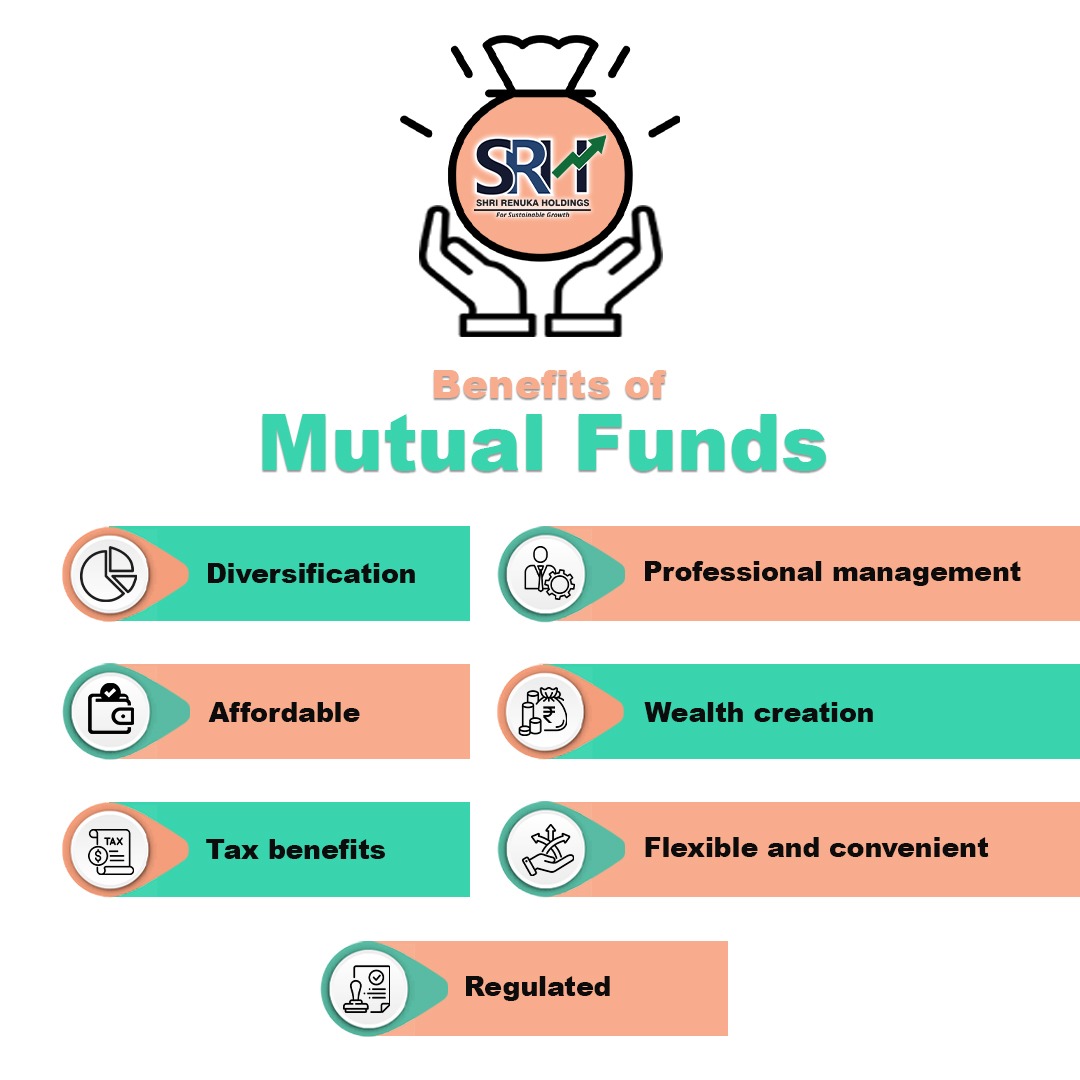

Top Seven Benefits of Mutual Funds

Mutual funds are becoming a popular investment option due to their multiple benefits. Before investing in one, continue reading to know about the benefits of investing in mutual funds. Managing their own money is often difficult for most individuals, and their challenges are compounded by the task of analyzing and studying various companies and commodities. Therefore, Indian investors are increasingly opting for mutual funds as it allow them to pool their capital in a professionally managed investment vehicle. For new investors, understanding the benefits of investing in mutual funds can help them make informed decisions.

🔹 Diversification

Everyone has heard the saying “do not put all your eggs in one basket”. This is to ensure investors do not lose all their capital by investing in a single asset class. Diversification is spreading the total investment across different asset classes. Mutual funds have inherent diversification as the corpus is invested in various securities, such as debt, equity, gold, real estate, and more based on the investment philosophy and objective of a particular scheme. Therefore, if one asset in the portfolio is not performing, the returns are not significantly impacted as it is offset by the performance of other portfolio holdings.

🔹 Professional management

Not every investor has the experience, expertise, knowledge, and time to conduct in-depth research and analysis. Mutual fund schemes are managed by professional fund managers who constantly monitor the investments and adjust the portfolio based on the market condition and movement. Additionally, the fund managers are supported by a team of research analysts who constantly research and analyze different securities to enable informed investment decisions.🔹 Flexible and convenient

Investing in mutual funds does not require a huge amount. Investors can opt for a systematic investment plan (SIP), which allows them to invest as low as INR 500 at regular intervals in their chosen mutual fund scheme. Investors can also increase the SIP amount or make a lump sum investment in case of they have additional capital.🔹 Affordable

Mutual funds pool capital from a large number of investors, which offers economies of scale. As a result, the expense ratio is lower. The expense ratio is the annual operating expenses of a mutual fund scheme, which is a percentage of the scheme’s net assets. Therefore, only a small amount of the investment capital is deducted towards covering the expense ratio and balance invested in the underlying securities.Top seven benefits of investing in mutual funds