- info@srhworld.com

- +91 (20) 24616106 | Helpline : +91 84849 14844

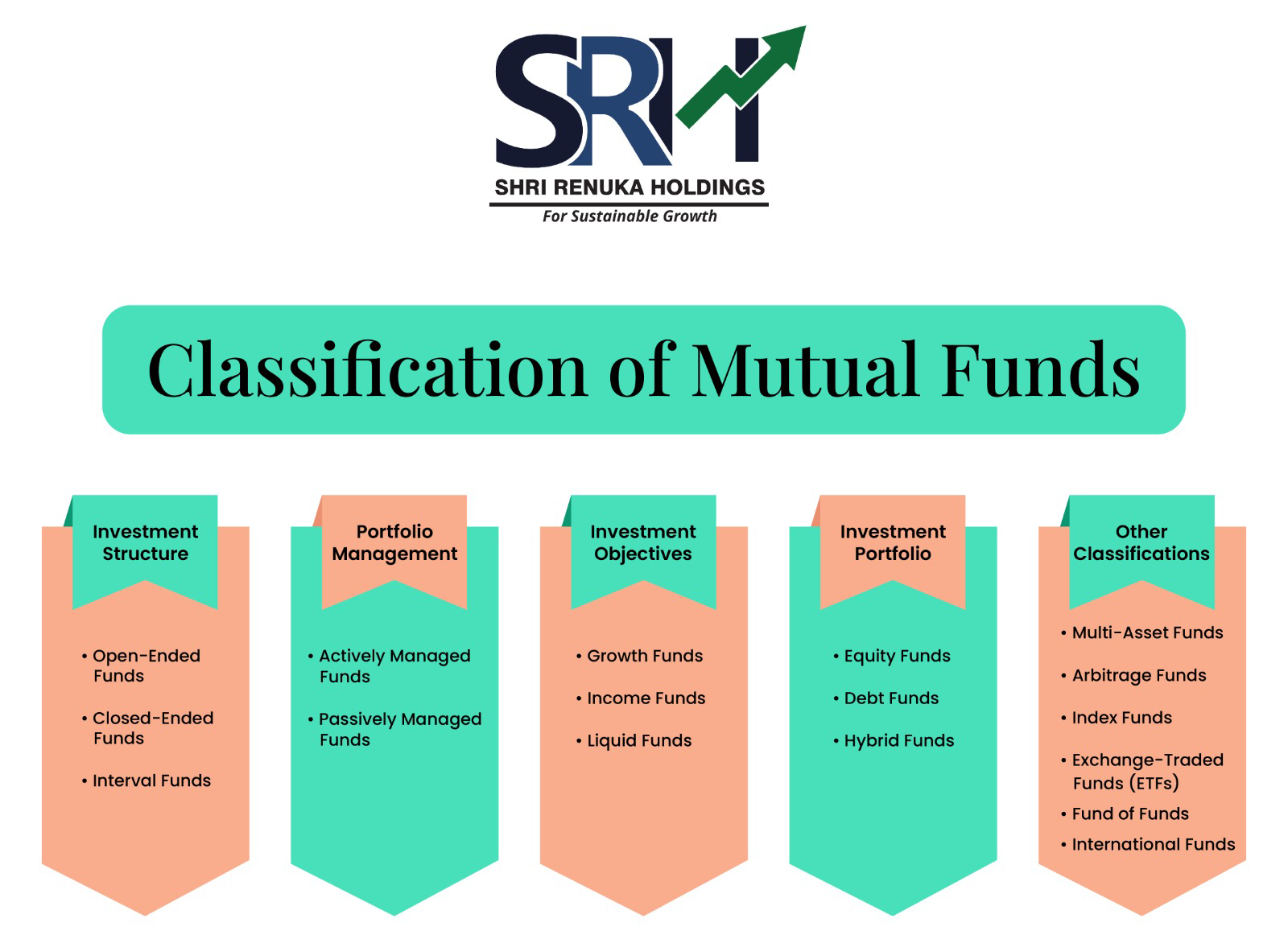

Classification of Mutual Funds in India

Based on organization structure

➔ Open Ended

these are open for subscription and redemption on any working day at the prevailing NAV➔ Close Ended:

the units are issued during initial offering and can be redeemed on the maturity date; these schemes are listed on stock exchanges to offer exit before maturity➔ Interval Funds :

sale and purchase of units can be done during specific periods, which is for at least two days and a gap of 15 days between two intervalsBased on portfolio management

➔ Actively Managed

the fund managers actively decide on which assets to buy, sell, or hold in the scheme corpus➔ Passively Managed

the fund corpus is invested as a replica of the stated benchmark or indexBased on investment objectives

➔ Growth Funds

majority of the corpus is invested in growth driven assets like equity and these schemes are subject to risks associated with market volatility➔ Income Funds

these schemes offer regular income as the corpus is invested in fixed-income securities like government bonds, debentures, and others➔ Liquid Funds

the corpus is invested in securities that have a maximum maturity of 91 days and the returns depend on the prevalent short-term interest ratesBased on investment portfolio

➔ Equity Funds

the pooled money is invested in equity and equity-related instruments with an objective to deliver higher returns over the long-term by riding out the short-term market volatility➔ Debt Funds

the fund corpus is invested in debt securities and bonds issued by the government, private companies, and public financial institutions➔ Hybrid Funds

the money is invested in both debt and equity instruments to create a balance between growth and incomeBased on other classification

➔ Multi-Asset Funds

wherein the money is invested across different assets, such as debt, equity, real estate, gold, and others to provide greater diversification to balance risk and reward while offering stable returns➔ Arbitrage Funds

the fund manager buys an asset in the cash market and simultaneously sells it in the Futures market at a higher price to take advantage of the difference in the two markets➔ Index Funds

the securities held in these schemes mirror those included in the benchmark index➔ Exchange-traded funds (ETFs)

these are marketable securities that track an index, commodity, bonds, or a basket of multiple assets and are listed on the stock exchanges➔ Fund of Funds (FoF)

the corpus is invested in other schemes either within the same AMC or another AMC➔ International Funds

the pooled money is invested in international assets, such as equities, ADRs and GDRs of Indian companies, debt securities of companies listed in international markets, and global ETFsWith the large number of mutual fund options, finding one that best suits your goals is confusing. SRH experts will work with you to understand your requirements, risk appetite, and investment horizon to build the most beneficial mutual fund portfolio.