- info@srhworld.com

- +91 (20) 24616106 | Helpline : +91 84849 14844

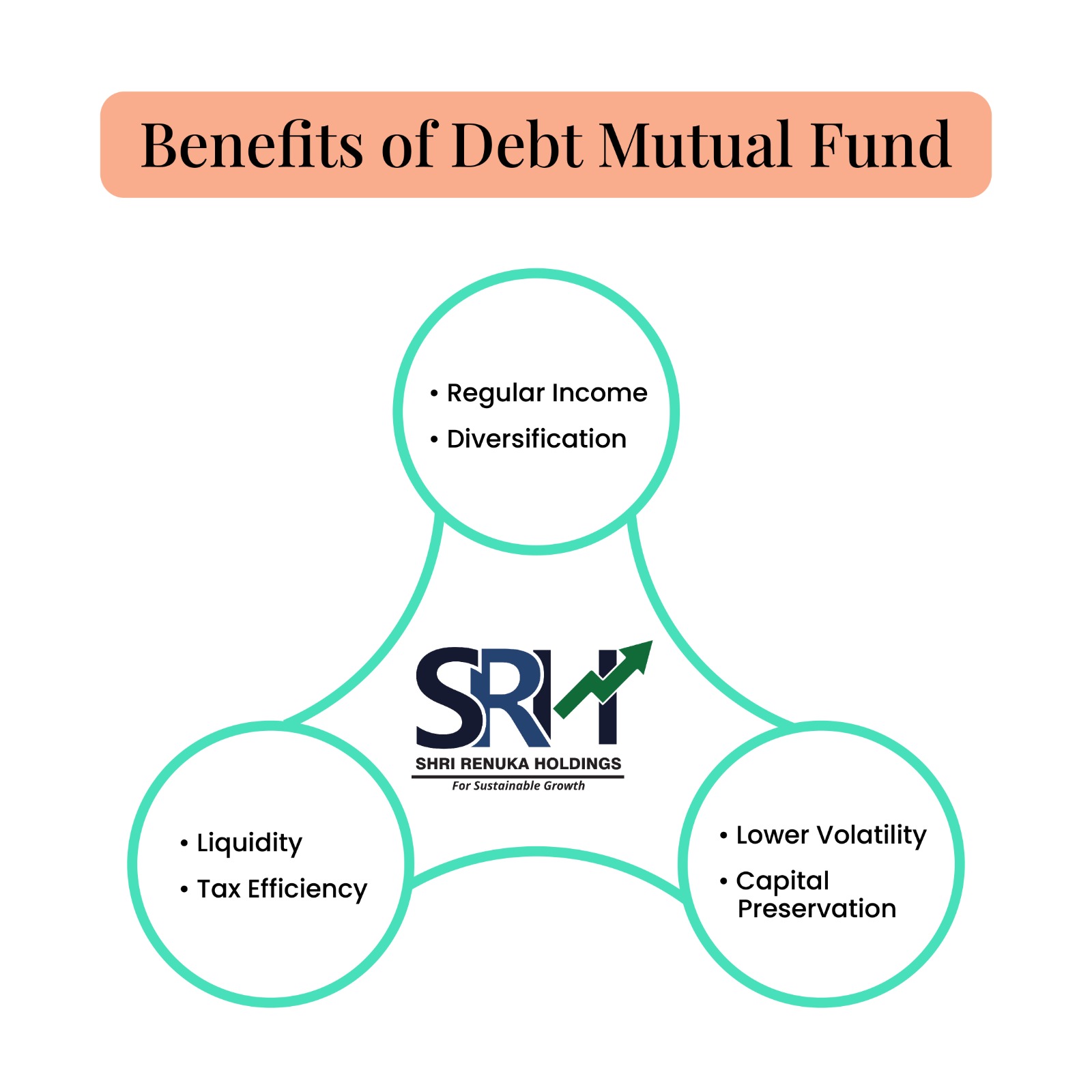

Benefits of Debt Mutual Funds and Who Should Invest

Debt funds invest the corpus in fixed-income securities like corporate bonds, government securities, and others. Individuals can invest in these funds for a duration from one day up to three years. Compared to fixed deposits and bank savings accounts, the post-tax returns on debt funds are higher. The risk level depends on the lending duration and the borrower profile.

Benefits of debt funds

🔹 Regular Income

Debt funds primarily invest in fixed-income securities like bonds, government securities, corporate debentures, and others. These instruments provide regular income in the form of dividends or interest payments.

🔹 Diversification

The corpus is invested in a variety of fixed-income securities issued by multiple issuers in various sectors with different maturities. Such diversification mitigates the risk associated with individual securities and can enhance overall portfolio stability.

🔹 Lower Volatility

Compared to equity funds, debt funds generally exhibit lower volatility since they are less affected by market fluctuations. This makes debt funds suitable for investors with lower risk tolerance or those seeking capital preservation.

🔹 Capital Preservation

Debt funds typically aim to preserve capital while providing modest returns. Investors with a conservative risk appetite or those nearing retirement may prefer debt funds to safeguard their investments.

🔹 Liquidity

These types of funds provide liquidity as investors can redeem their investments at any time to meet their fund requirements. This versatility makes these a suitable option for short to medium-term tenure.

🔹 Tax Efficiency

If an investor holds these funds for a period exceeding three years long-term capital gains tax is applicable. Compared to the short-term capital gains (levied on investments held for less than three years) LTCG tax is lower making these a tax-efficient investment product.

Who should consider investing in debt funds?

🔹 Conservative Investors

Individuals who have a lower risk appetite and prefer capital preservation may opt for debt funds. Conservative investors are willing to forego the potentially higher returns to ensure principal protection and may opt to invest in debt funds.

🔹 Retired Individuals

Investors who are retired or may retire within a short time may invest in these funds. Debt funds are an excellent option to generate regular income while protecting their principal from market volatility and risk.

🔹 Investors with short to medium-term goals

Investors with short to medium-term financial goals, such as saving for a down payment on a house or funding their child's education, may consider debt funds due to their stability and liquidity.

🔹 Tax-Sensitive Investors

Investors looking for tax-efficient investment options with an investment horizon of three years or longer may choose debt funds. The LTCG tax on these funds is lower, which enables investors to earn tax-efficient returns.

🔹 Portfolio Diversification

Putting all the eggs in a single basket is highly risky. Therefore, investors may opt to invest in debt mutual funds to diversify their investment portfolio beyond equities and mitigate the overall risk of allocating some portion of their capital to fixed-income securities.

Debt funds have several benefits but, like other investment products, have certain inherent risks. Before investing, investors must assess their investment objectives, risk appetite, and tenure. Additionally, seeking guidance from qualified experts at SRH ensures that their investments align with their overall financial goals and plans.