- info@srhworld.com

- +91 (20) 24616106 | Helpline : +91 84849 14844

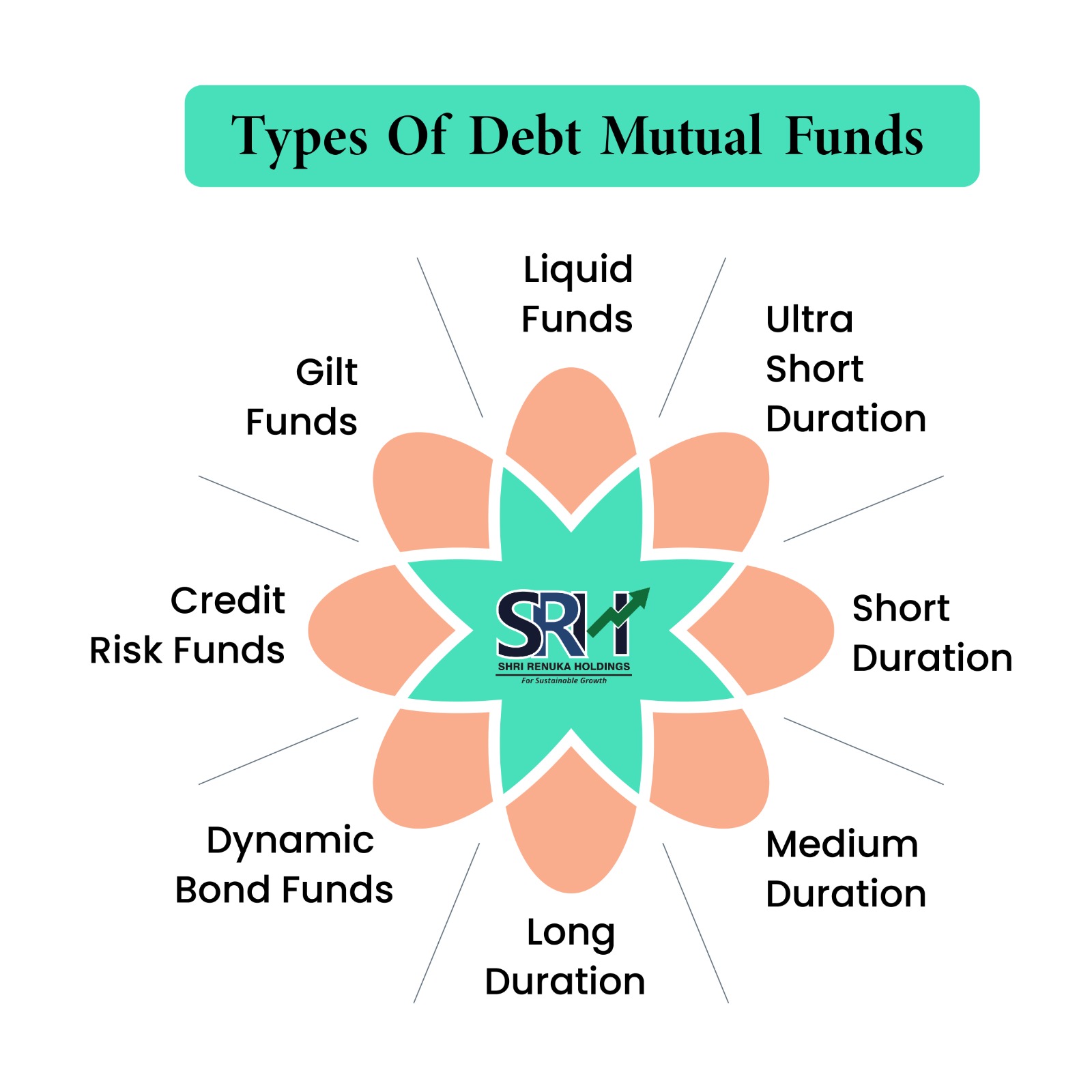

Types of Debt Mutual Funds: Choose the Right Option for Your Investment Goals

Types of Debt Mutual Funds

Debt funds provide diversification to the investment portfolio of an individual. These offer stability, regular income, and risk mitigation. Debt funds invest in fixed-income securities, such as commercial papers, corporate bonds, government securities, treasury bills, and other money-market instruments.

The returns are not impacted by market fluctuations, making debt funds low-risk investments. Based on the maturity period, debt funds can be of different types. Below is a summary of these types, their characteristics, risk factors, and suitability for various financial goals.

Liquid Funds

Investment: Short-term money market instruments with a maturity period of up to 91 days, offering high liquidity and low volatility

Suitable for: Investors seeking capital preservation and easy liquidity, such as corporates, institutions, and short-term investors

Ultra Short Duration Funds

Investment: Securities with a maturity period ranging from three to six months

Suitable for: Investors with a slightly higher risk appetite looking for better returns than savings accounts or fixed deposits, with relatively lower interest rate risk

Short Duration Funds

Investment: Debt securities with a duration between one and three years, offering higher returns compared to liquid and ultra-short duration funds

Suitable for: Investors with a moderate risk appetite seeking stable returns over a short to medium-term horizon

Medium Duration Funds

Investment: Instruments with a duration of three to four years, offering a balance between risk and return

Suitable for: Investors with a moderate risk appetite and a medium-term investment horizon

Long Duration Funds

Investment: Debt securities with a longer maturity period, generally exceeding seven, making them sensitive to interest rate changes

Suitable for: Investors with a long-term investment horizon who can tolerate fluctuations in returns due to interest rate movements

Dynamic Bond Funds

Investment: Flexibility to invest across various durations based on the fund manager's outlook on interest rates, aiming to capture opportunities arising due to dynamic market conditions

Suitable for: Investors seeking active management of their debt portfolio and willing to assume moderate to high interest rate risk

Credit Risk Funds

Investment: Lower-rated debt instruments, offering higher yields but carrying higher credit risk

Suitable for: Investors with a higher risk appetite and a longer investment horizon to earn potentially greater returns

Gilt Funds

Investment: Government securities offering safety of principal with slight interest rate risk

Suitable for: Risk-averse investors seeking safety and stability in their investment portfolio, especially during uncertain economic conditions

Debt funds offer a wide range of options catering to various financial goals, risk appetites, and investment tenure. It is important for investors to understand the characteristics and risk factors associated with each type of debt fund before making their investment decisions. Consulting with an experienced financial advisor like SRH can also provide valuable insights tailored to individual financial goals and risk profiles. By diversifying across different types of debt mutual funds, investors can build a resilient portfolio that balances risk and return effectively.